Standard Deduction Married Filing Jointly 202 2025

Standard Deduction Married Filing Jointly 202 2025. Publication 17, your federal income tax (returns normally due april 2026)

Your date of birth, your spouse’s date of birth, and filing status. If you’re a single filer, the current standard deduction will trim your agi by $14,600, and that jumps to $29,200 if you’re married and filing jointly.

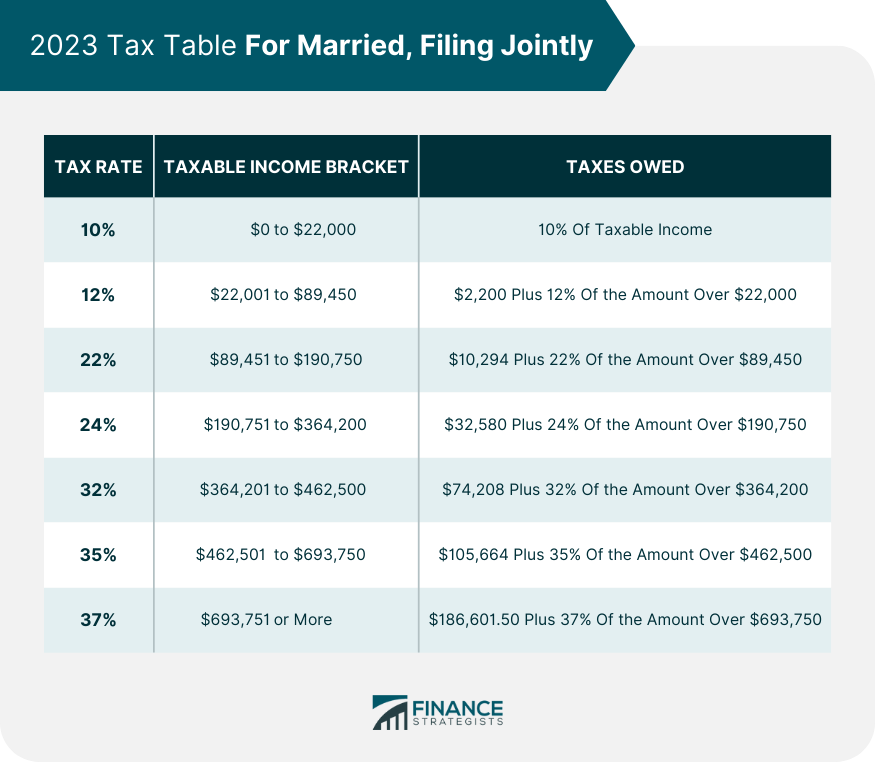

Standard deduction Married filing jointly and surviving spouses Single, The standard deduction for 2025 is $15,000 for single filers and married people filing separately, $22,500 for heads of household, and $30,000 for those married filing jointly and surviving.

Standard Deduction Every Filing Status 2025 2025, The calculator automatically determines whether.

Standard deduction for married filing jointly vs separately. TurboTax, It was nearly doubled for all classes of filers by the 2017 tax cuts and jobs act as an.

2025 Standard Deduction Married Filing Jointly Calculator Barb Katinka, The standard deduction for couples filing jointly will be $30,000, up $800 from 2025;

2025 Standard Deduction Married Filing Jointly Over 65 Alleen Laurianne, If you’re a single filer, the current standard deduction will trim your agi by $14,600, and that jumps to $29,200 if you’re married and filing jointly.

2025 Federal Standard Deduction For Married Filing Jointly Merla Stephie, For heads of households, the standard deduction will be $22,500 for tax.

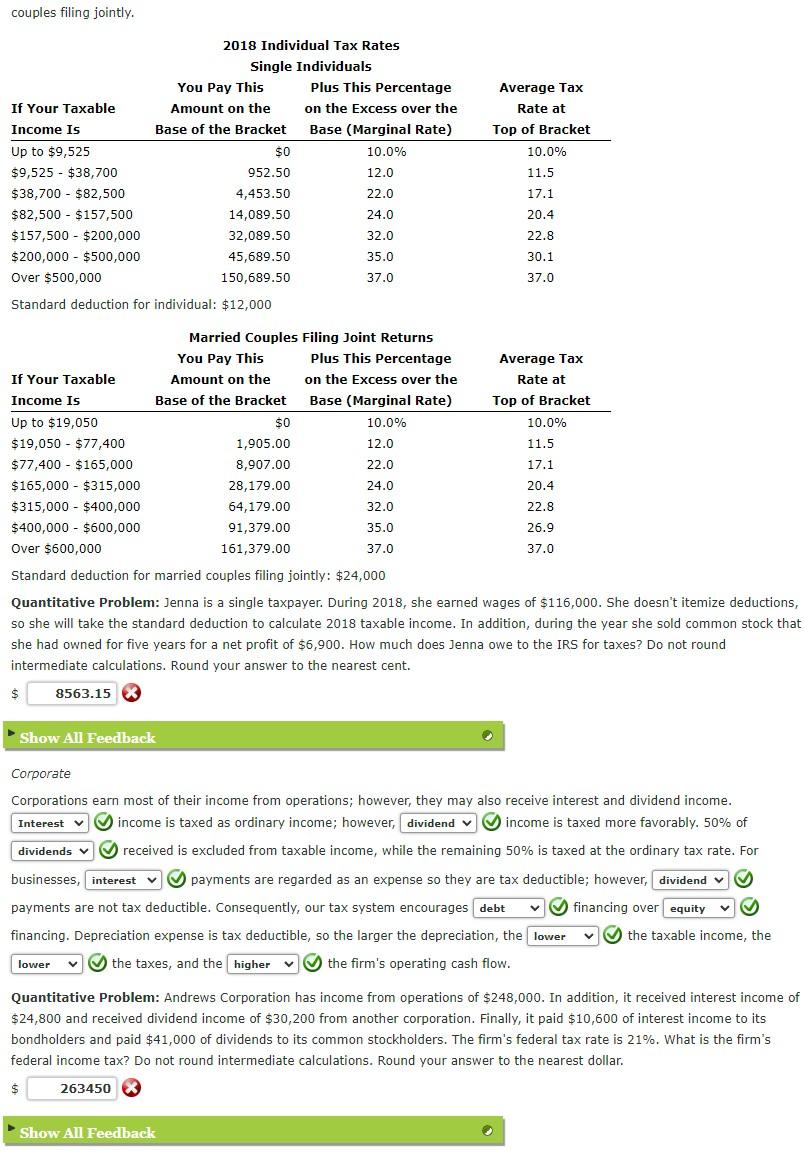

2025 Standard Tax Deduction Married Jointly Meaning Berny Celesta, After the tcja was enacted, the base standard deduction amounts jumped to $13,000 (single filers) and $24,000 (married filing jointly).

2025 Standard Deduction Married Filing Jointly Over 65 Carol Cristen, $30,000 for married individuals filing jointly and surviving spouses, $22,500 for heads of households, and;

2025 Standard Deduction Married Filing Jointly For Seniors Anthe Merilyn, The standard deduction will rise to $15,000 for single filers and married individuals filing.

Cleaning Services Agency WordPress Theme By Classic Templates